The Indian stock market has been buzzing with excitement as the Saatvik Green Energy IPO finally opened for subscription. Known for its strong presence in the renewable energy sector, Saatvik Green Energy Limited has become one of the most discussed IPOs of 2025. With the subscription window open from September 19 to September 23, many investors are eager to know whether this IPO is a good investment bet or just market hype.

In this article, we’ll explore every aspect of the Saatvik Green Energy IPO — from its price band, grey market premium (GMP), subscription status, and financials, to expert reviews that can help investors make informed decisions.

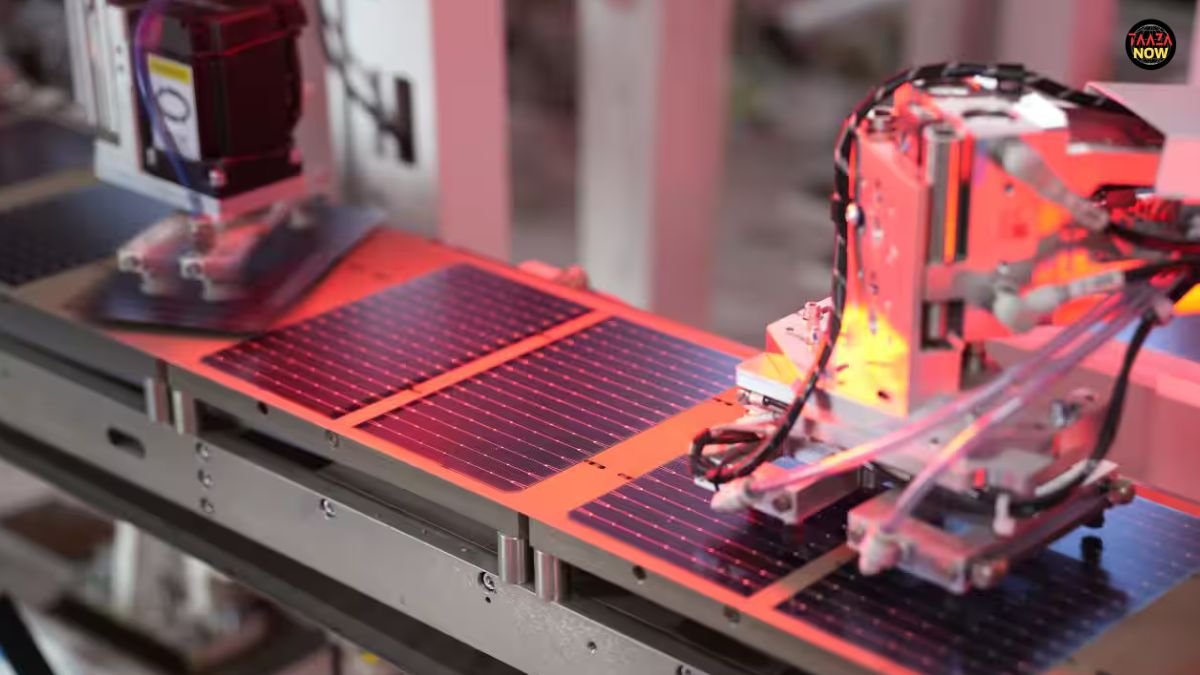

What is the Saatvik Green Energy IPO?

Saatvik Green Energy Limited, a leading name in solar manufacturing and renewable energy solutions, has launched its initial public offering (IPO) to raise ₹900 crore. Out of this, ₹700 crore will come from fresh equity shares, while ₹200 crore is reserved for an Offer for Sale (OFS).

The company has set the Saatvik Green Energy IPO price band between ₹442 and ₹465 per equity share. The IPO will be listed on both BSE and NSE, giving it wider visibility and trading opportunities.

Grey Market Premium (GMP) of Saatvik Green Energy IPO

Even before the IPO subscription opened, the Saatvik Green Energy IPO GMP created a strong buzz in the market. On the opening day, its shares were trading at a premium of ₹78 in the grey market. This indicates a potential listing gain of around 17% for investors who get allotment at the upper end of the price band.

Grey market trends often reflect investor sentiment, and in this case, the demand seems promising. However, experts also caution that GMP is not always a reliable indicator, and investors must evaluate the fundamentals before making a decision.

Subscription Status of Saatvik Green Energy IPO

By the third day of bidding (till 3:39 PM), the subscription numbers showed mixed results:

- Overall Subscription: 0.48 times booked

- Retail Portion: 0.75 times subscribed

- Non-Institutional Investors (NII): 0.48 times filled

These numbers suggest that retail investors have shown more enthusiasm compared to institutional buyers. With still some time left before closing, the subscription figures may see further improvement.

Also Read: Ladki Bahin Yojana: Maharashtra Government Makes e-KYC Mandatory for Beneficiaries

Key Details of Saatvik Green Energy IPO

To give you a quick summary, here are the major highlights of the Saatvik Green Energy IPO:

- IPO Price Band: ₹442 – ₹465 per equity share

- IPO Dates: September 19 to September 23, 2025

- IPO Size: ₹900 crore (₹700 crore fresh issue + ₹200 crore OFS)

- Lot Size: One lot comprises 32 shares

- Allotment Date: Expected on September 24, 2025

- Listing Date: Likely on September 26, 2025 (BSE & NSE)

- Registrar: KFin Technologies Limited

- Lead Managers: DAM Capital Advisors, Ambit, and Motilal Oswal Investment Advisors

Financial Performance of Saatvik Green Energy

One of the biggest reasons behind the excitement around the Saatvik Green Energy IPO is the company’s solid financial growth. In FY25, the company reported revenue of ₹2,158.39 crore, showing a strong top-line expansion. Profit After Tax (PAT) doubled by 113%, reaching ₹213.93 crore.

This strong financial performance reflects the company’s ability to scale operations in the growing renewable energy sector. However, investors should also be aware of its dependence on government policies and its high revenue concentration from top clients, which could pose risks in the long run.

Valuation of Saatvik Green Energy IPO

At the upper end of the price band, the Saatvik Green Energy IPO seeks a market capitalization of around ₹5,910 crore. Based on FY25 revenue, this translates into a Market Cap-to-Sales multiple of 2.74x.

The company’s Price-to-Earnings (P/E) ratio stands at approximately 24.4x, which may look slightly expensive compared to some peers. However, given the company’s rapid growth trajectory and strong positioning in the solar manufacturing industry, analysts believe the valuation is justified.

Also Read: Adani Enterprises Share Price Gains as SEBI Clears Part of Hindenburg Allegations

Expert Reviews on Saatvik Green Energy IPO

Several market analysts and brokerage houses have shared their views on whether investors should subscribe to the Saatvik Green Energy IPO:

- Lakshmishree Investment: Their Head of Research, Anshul Jain, has given a “Subscribe” rating. He highlighted the company’s exceptional growth and noted that while valuation seems fully priced, long-term investors can benefit from its strong fundamentals.

- BP Equities: They have also recommended a “Buy”, pointing out that Saatvik’s P/E ratio is relatively lower than many of its industry peers, making it attractive for medium to long-term gains.

- Kunvarji Finstock, DRChoksey Finserv, and Canara Bank Securities: All have issued a “Subscribe” recommendation, citing industry growth potential and strong market position.

- SMC Global Securities and Systematix Shares & Stocks: These firms have not provided a rating yet.

Risks Associated with Saatvik Green Energy IPO

While the growth story looks promising, potential investors must consider some risks:

- High Client Concentration: A large portion of revenue comes from its top 10 clients. Any loss of a major client could impact earnings significantly.

- Policy Dependence: Since renewable energy is heavily supported by government policies, any unfavorable changes could hurt business prospects.

- Market Volatility: The renewable energy sector is competitive, and global fluctuations in solar panel pricing could affect profitability.

Should You Invest in Saatvik Green Energy IPO?

The decision to invest in the Saatvik Green Energy IPO depends on your risk appetite and investment horizon. For short-term investors, the strong GMP suggests that listing gains are possible. For long-term investors, the company’s financial strength, industry potential, and growth prospects make it an attractive option.

However, investors should remain cautious about the risks and avoid overexposure. Diversifying across sectors is always advisable.

Taazanow.com- Click Here